Finance ADVOCACY

Protecting your investments and reputationWe advocate for responsible investment practices, urging the exclusion of deep sea mining from portfolios and promoting sustainable investment alternatives.

We provide investors with crucial resources to protect their finances and reputations. We champion responsible investment by urging the removal of deep sea mining from portfolios and advocating for sustainable alternatives.

Our targeted research, direct engagement, and strategic advocacy highlight the major risks of deep sea mining, especially its shortcomings in meeting Environmental, Social, and Governance (ESG) standards.

Staying informed and committed to responsible investment principles helps investors shield their portfolios from the financial and reputational dangers of this controversial industry.

Subscribe to our quarterly finance updates below or email DSMC’s Finance Advocacy Officer: andy@dsm-campaign.org

Subscribe to Quarterly Finance updates

Don’t risk the financial and reputational pitfalls or deep sea mining – stay informed and decisions that metter.

Our finance advocacy work

DSMC started finance advocacy work in 2017 to encourage divestment from the Nautilus Minerals Solwara 1 project in Papua New Guinea (PNG)’s territorial waters. As the first DSM project to be granted a mining license, Solwara 1 was seen as setting a precedent by companies and governments worldwide.

Our finance advocacy provides investors with resources to safeguard their financial and reputational interests given the Environmental, Social, and Governance (ESG) concerns around deep sea mining (DSM).

Our work aims to warn financiers and insurers of the high risks associated with DSM, hoping they will create specific policies excluding DSM or discouraging direct divestment in higher-risk DSM companies.

DSMC offers the investment and insurance industries a summary of DSM corporate interests to assist in determining exposure to pure-play companies, part-ownership and ancillary manufacturers.

Financial risks of deep sea mining

DSM is an experimental industry that carries a high level of technical, financial, environmental and reputational risk. Financial institutions, especially insurers, are rightly concerned about the risks of DSM.

Proponents of the sector claim that DSM is essential to supply the metals required for a global transition to renewable energy. However, existing terrestrial mineral stocks, progress towards the mining of electronic waste, advances towards the development of circular economies, and alternative sources of metals, challenge assertions that the seabed must be mined.

These claims also contradict the accumulated scientific consensus that mining the deep sea for minerals poses a significant risk to ocean ecosystems.

DSM also threatens the deep cultural and spiritual connections of Pacific islanders and maritime communities who have navigated, fished and traded across oceanscapes for thousands of years.

The feasibility and economic benefits of DSM are unsubstantiated. The world’s first licenced deep sea mining project, Solwara 1 in Papua New Guinea (PNG), has had a significant negative economic outcome for that nation. When Nautilus Minerals declared bankruptcy, PNG was burdened by debt, having been persuaded by that company to invest in its failed project.

The commercial viability of DSM is a significant unknown, with only a limited number of companies willing to accept that risk.

Financial institutions excluding support for deep sea mining

Financial institutions are increasingly developing policies that explicitly exclude the provision of financial services for DSM activities to avoid biodiversity loss and further environmental stress on the planet’s oceans.

Due to the risks posed by DSM, the United Nations Environment Programme Finance Initiative – which brings together the UN with banks, insurers and investors to shape the sustainable finance agenda – has concluded that the extraction of seabed deposits cannot be considered sustainable, and urges financial institutions to not support the sector.

In recognition of the risks associated with DSM and the expectations of their stakeholders, a number of financial institutions (see table below) have published policies that explicitly exclude the provision of financial services for DSM activities.

Other financial institutions have also joined a business statement supporting a moratorium.

Banks have been the first to develop policies excluding services to DSM, however, the insurance sector also has a powerful role to play in determining the viability of extractive industry projects. For example, the denial of insurance to fossil fuel projects increasingly hampers their development.

The uncertainties surrounding DSM make it impossible to accurately quantify the associated risks. This is especially concerning for the insurance sector, which would bear the financial burden in the event of failure.

Exclusion of Deep Sea Mining

| FINANCIAL INSTITUTION | TYPE | PUBLISHED POLICY | READ POLICY |

|---|---|---|---|

| Bank | (from their exclusion list) “Commercial large scale deep sea mining beyond exclusive economic zones.” | Read more |

| Bank | "BBVA will not support the provision of financial services to clients or projects who are involved in ... seabed mining" | Read more |

| Bank | “Will not provide any project-related financing towards the exploration or extraction of mineral deposits of the deep seabed” and “will not provide any lending or capital markets underwriting to companies that are primarily engaged in the exploration or extraction of mineral deposits from the deep seabed” | Read more |

| Bank | While the bank observes global developments around deep-sea mining and the respective environmental and social research that is being undertaken, it has introduced the following requirement, becoming effective Q4 2024:— No direct financing of deep-sea mining projects | Read more |

| Public financier | “The following activities cannot benefit from EIB financing: ... b. Projects unacceptable in climate and environmental terms ... Extraction of mineral deposits from the deep sea ... 13. Deep sea is defined as the areas of the ocean below 200 m — The International Seabed Authority and Deep Seabed Mining. United Nations.” | Read more |

| Reinsurer | “the facultative division has not underwritten any projects connected with deep sea mining since 2023.” | Read more |

| Bank | “Lloyds Banking Group will not support (new or existing) customers undertaking deep-sea mining.” | Read more |

| Bank | “restricted list includes 'companies undertaking deep-sea mining." | Read more |

| Bank | "We will not provide financial services directly towards: … The exploration or production of Deep-sea Mining projects." | Read more |

| Asset Manager | “Following the precautionary principle, Storebrand will not invest in companies involved in deep-sea mining until we have more scientific knowledge on the impacts of these activities.” | Read more |

| Reinsurer | “Based on key sustainability risks identified for this sector, for direct or facultative re/insurance transactions, Swiss Re does not support activities: … That retrieve mineral deposits from the deep seabed (eg deep-sea mining projects).” | Read more |

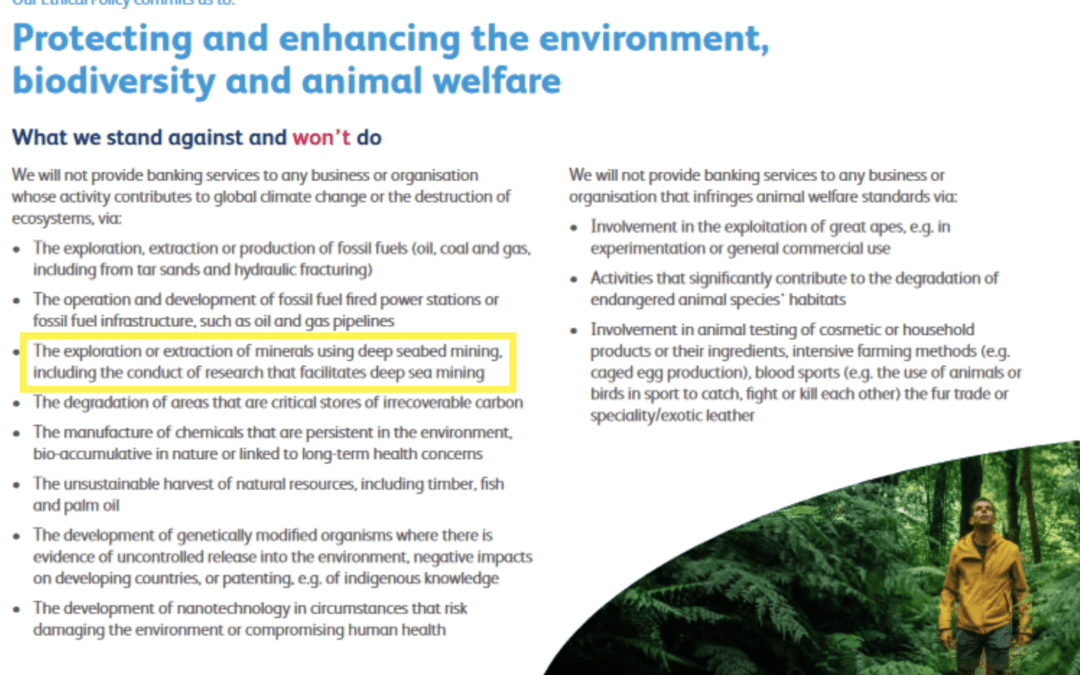

| Bank | “Will not provide banking services to any business or organisation whose activity contributes to global climate change or the destruction of ecosystems [including] … the exploration or extraction of minerals using deep seabed mining, including the conduct of research that facilitates deep sea mining.” | Read more |

| Bank | “Triodos Bank excludes companies that: ... Are involved in controversial mining activities, for example, deep sea mining or asbestos mining.” | Read more | |

| Insurer | “VIG is not providing any risk coverage for nonconventional exploration of oil and gas. This includes shale gas and shale oil, tight gas and tight oil, as well as all kinds of new deep sea mining projects.” | Read more |

| Insurer | “Zurich Insurance Group AG has confirmed to the Deep Sea Mining Campaign that we do not have any appetite to insuring these types of mining activities.” | Read more |

Deep sea mining companies

Nautilus Minerals / DSMF

Our early finance campaign focused on persuading Nautilus shareholders to divest and advise banks – identified by our research as possible sources of finance – of the risks associated with the project.

This work coincided with a legal challenge and on-the-ground advocacy in Papua New Guinea.

DSMC achieved major success in 2018 in persuading AngloAmerican to divest from deep sea miner, Nautilus Minerals. Nautilus filed for bankruptcy in early 2019.

While the bankruptcy has damaged the chances of the project proceeding, the two main investors have used the bankruptcy process to create a ‘new Nautilus’ called Deep Sea Mining Finance (DSMF) that has shed its debt at the expense of other shareholders, including the Papua New Guinean Government losing AUD$157m.

We continue to retain a watching brief on DSMF with our local partners in Papua New Guinea.

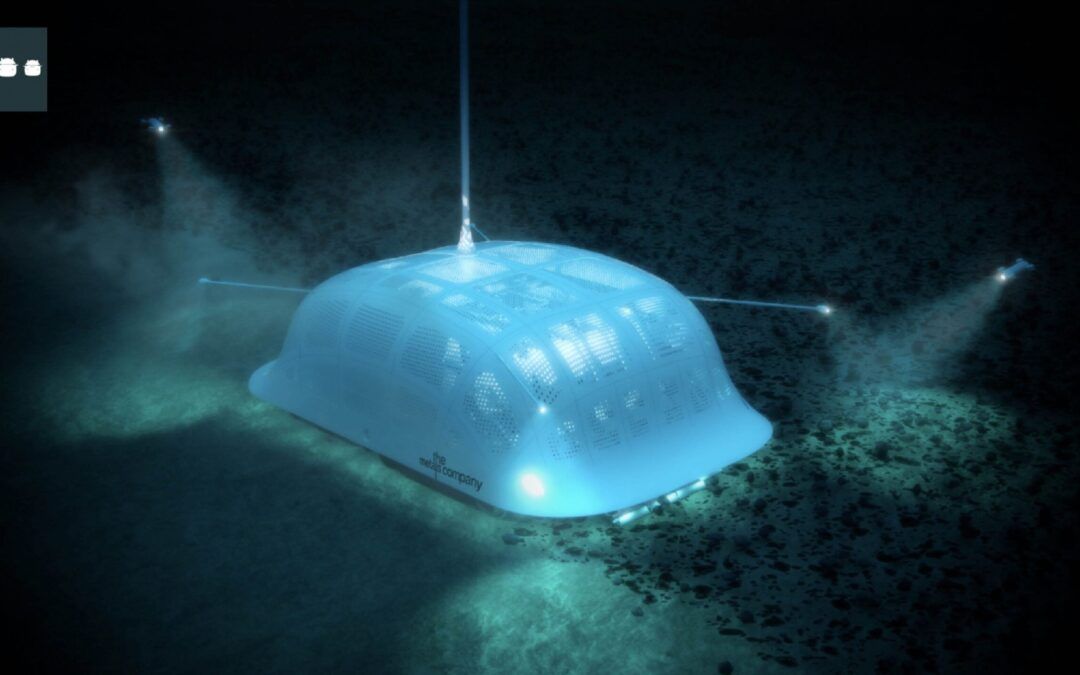

The Metals Company

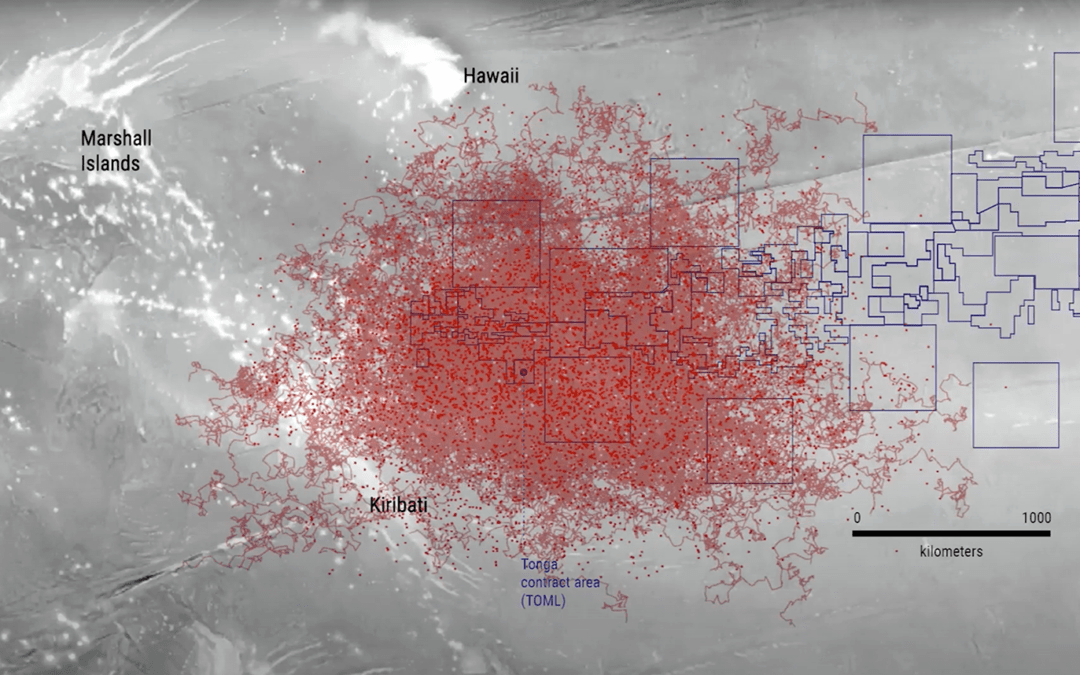

The Metals Company (TMC) holds several vast exploration licenses in the Clarion Clipperton Zone of the Pacific Ocean. Established by former senior Nautilus personnel, TMC became a public company via a reverse merger with a Special Purpose Acquisition Company called Sustainable Opportunities Acquisition Corp (SOAC) in September 2021.

During the merger over 90% of warrant holders redeemed rather than invested in the new company, two PIPE investors failed to complete, and the shares initially lost 90% of their share value one year after launch.

DSMC published a shareholder advisory forcing TMC to revise its stated risks with the SEC.

The Pacific Island of Nauru, which sponsor some of TMC’s international leases, has triggered an obscure legal provision called the ‘2-year rule’, that would allow the International Seabed Authority to begin taking applications for commercial deep sea mining projects by July 2023 with whatever rules are in place at that time.

TMC states publicly it intends to start mining in late 2025 or early 2026 in the Pacific Ocean. As a start-up company with limited funds its rush to begin commercial mining is driven by financial imperatives. However, commercial deep sea mining (DSM) can only occur in international waters if approved by the International Seabed Authority (ISA).

DSMC has produced a briefing paper that provides a reality check on the likelihood of TMC being granted a contract by the ISA to mine in the Pacific Ocean. It analyses and clarifies the significant legal, technical and political barriers that are likely to delay, or even completely obstruct TMC recieving a contract and delivering on promises to investors.

We continue to retain a watching brief on TMC with our partners in the Pacific and Internationally.

Finance and investor news