Finance

Information on Deep Sea Mining for Investors

The Deep Sea Mining Campaign (DSMC) is the civil society organisation taking the lead on engaging financial institutions on deep sea mining (DSM).

We produce quarterly updates, which inform financiers and related actors on the growing risks associated with deep sea mining.

If you would like more information, or to receive the updates, please email: andy@dsm-campaign.org

Information for Investors

OUR Finance Advocacy

Our finance advocacy provides investors with resources to safeguard their financial and reputational interests given the Environmental, Social, and Governance (ESG) concerns around deep sea mining (DSM).

The Deep Sea Mining Campaign (DSMC) started finance advocacy work in 2017 to encourage divestment from the Nautilus Minerals Solwara 1 project in Papua New Guinea (PNG)’s territorial waters. As the first DSM project to be granted a mining license, Solwara 1 was seen as setting a precedent by companies and governments around the world.

It aims to warn financiers and insurers of the high risks associated with DSM, hoping they will create specific policies excluding DSM or discouraging direct divestment in higher-risk DSM companies.

Deep Sea Mining Campaign offers the investment and insurance industries a summary of DSM corporate interests to assist in determining exposure to pure-play companies, part-ownership and ancillary manufacturers.

The Financial Risk of Deep Sea Mining

Deep sea mining (DSM) is an experimental industry that carries a high level of technical, financial, environmental and reputational risk.

Financial institutions, especially insurers, are rightly concerned about such risks.

Proponents of the sector claim that DSM is an ‘environmentally friendly’ alternative to terrestrial mining essential for the swift transition to renewable energy. These claims contradict the accumulated scientific consensus that mining the deep sea for minerals poses a significant risk to ocean ecosystems. DSM also threatens the deep cultural and spiritual connections of islanders and maritime communities who have navigated, fished and traded across oceanscapes for thousands of years.

The commercial viability of DSM is a significant unknown, with only a limited number of companies willing to accept that risk.

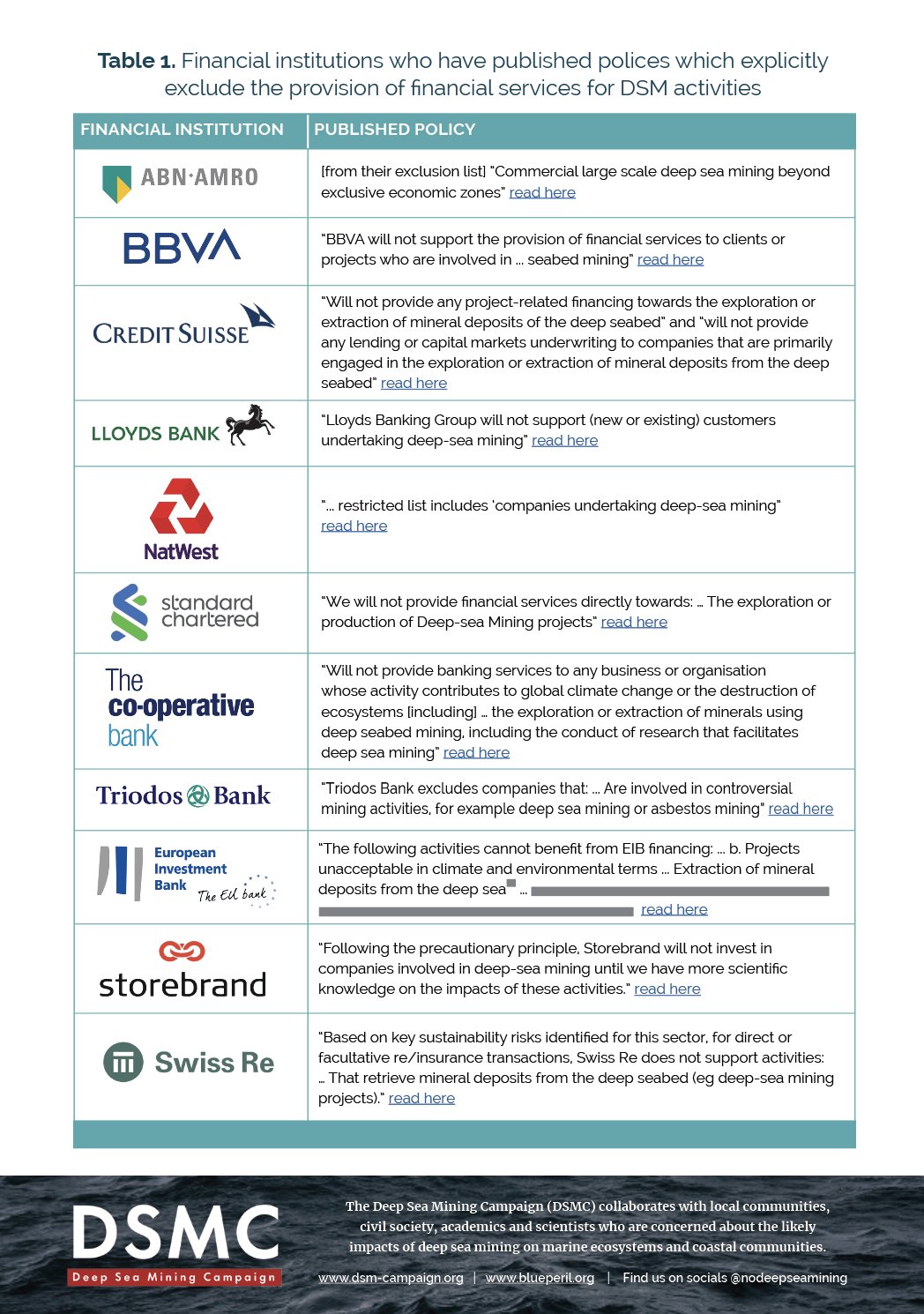

Financial institutions excluding support for Deep Sea Mining

Financial institutions are increasingly developing policies seeking to avoid biodiversity loss and further environmental stress on the planet’s oceans.

Due to the risks posed by deep sea mining (DSM), the United Nations Environment Programme Finance Initiative – which brings together the UN with banks, insurers and investors to shape the sustainable finance agenda – has concluded that the extraction of seabed deposits cannot be considered sustainable, and urges financial institutions to not support the sector.

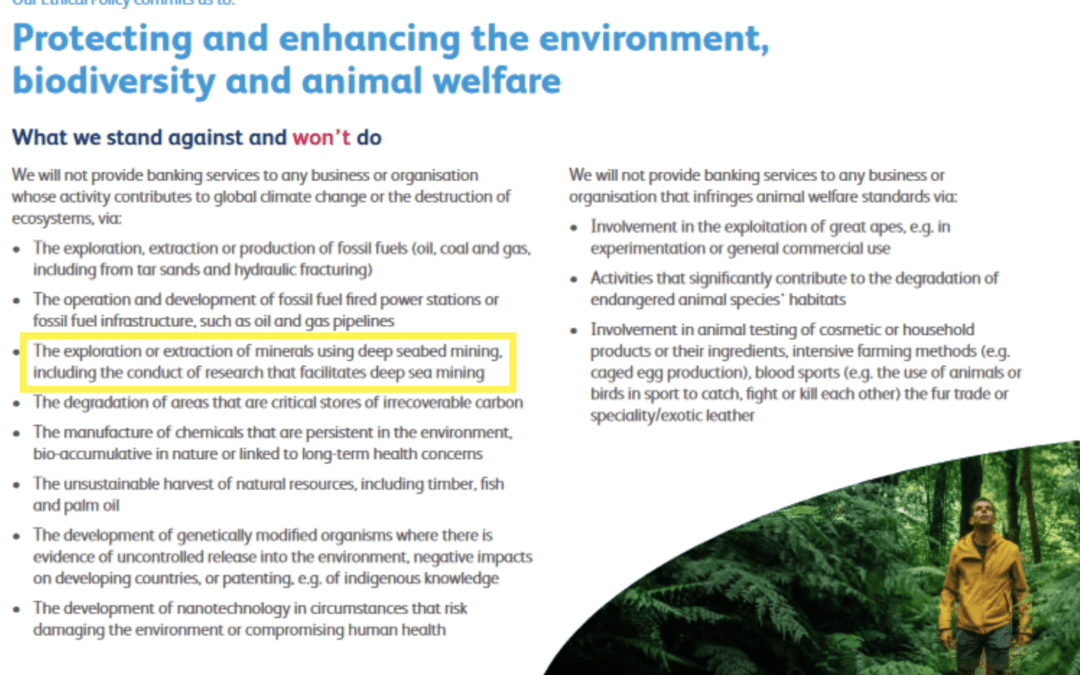

In recognition of the risks associated with deep sea mining and the expectations of their stakeholders, a number of financial institutions have published policies that explicitly exclude the provision of financial services for deep sea mining activities.

Other financial institutions have also joined a business statement supporting a moratorium.

Insurance and Deep Sea Mining

Banks have been the first to develop policies excluding services to deep sea mining, however, the insurance sector also has a powerful role to play in determining the viability of extractive industry projects.

For example, the denial of insurance to fossil fuel projects increasingly hampers their development.

The many uncertainties relating to deep sea mining means it is not currently possible to quantify associated risks. This should be of particular concern to the insurance sector as it would ultimately carry the financial burden of failure.

Nautilus Minerals / DSMF

The Deep Sea Mining Campaign achieved a major success in 2018 in persuading Anglo American, the only mainstream mining company shareholder, to divest from deep sea miner Nautilus Minerals. Nautilus filed for bankruptcy in early 2019.

Our finance campaign focused on persuading Nautilus shareholders to divest and advise banks – identified by our research as being possible sources of finance – of the risks associated with the project.

This work occurred simultaneously with a legal challenge and on-the-ground advocacy in Papua New Guinea.

While the bankruptcy has clearly damaged the chances of the project proceeding, the two main investors have used the bankruptcy process to create a ‘new Nautilus’ called Deep Sea Mining Finance (DSMF) that has shed its debt at the expense of other shareholders, including the Papua New Guinean Government losing AUD$157m.

We continue to retain a watching brief on DSMF with our local partners in Papua New Guinea.

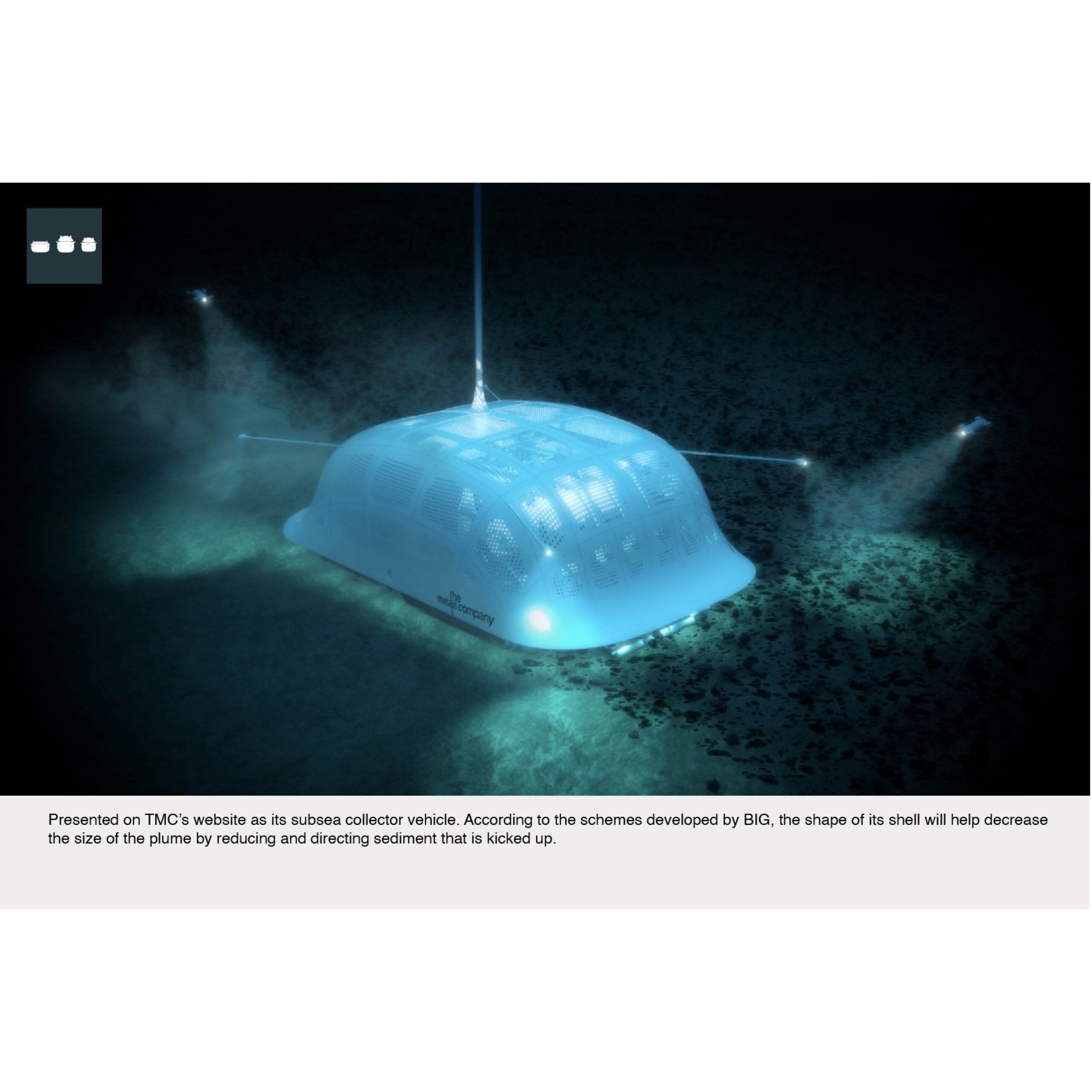

The Metals Company

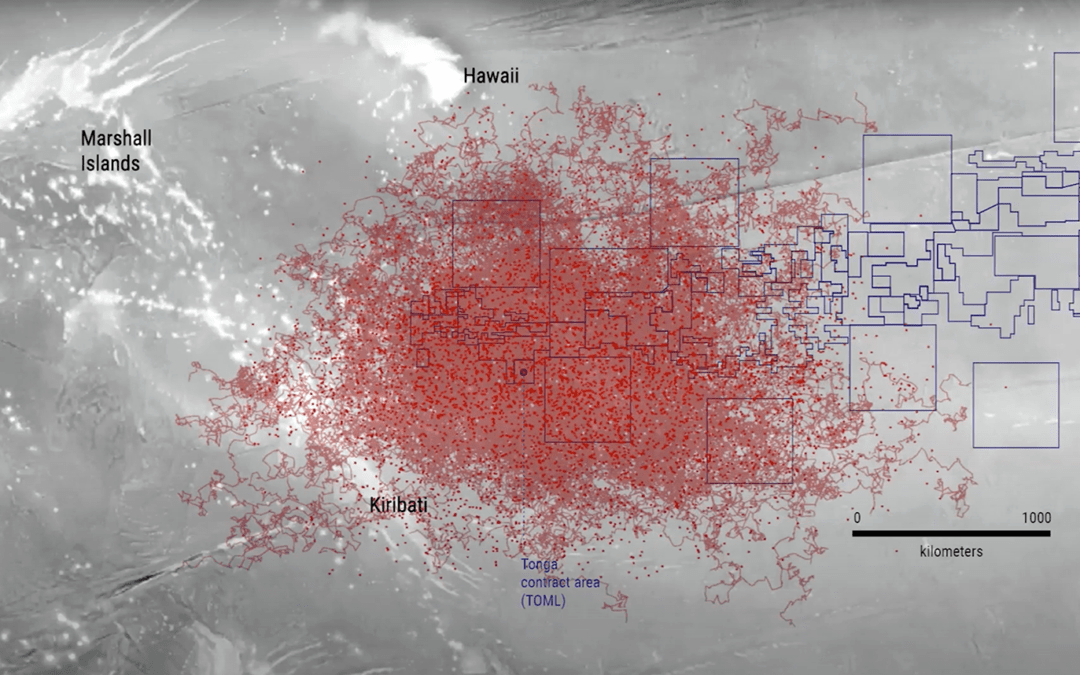

The Metals Company (TMC) holds several vast exploration licenses in the Clarion Clipperton Zone of the Pacific Ocean.

Established by former senior Nautilus personnel, TMC became a public company via a reverse merger with a Special Purpose Acquisition Company called Sustainable Opportunities Acquisition Corp (SOAC) in September 2021.

During the merger over 90% of warrant holders redeemed rather than invested in the new company, two PIPE investors failed to complete, and the shares initially lost 90% of their share value one year after launch.

We published a shareholder advisory forcing TMC to revise its stated risks with the SEC.

The Pacific Island of Nauru, which sponsor some of TMC’s international leases, has triggered an obscure legal provision called the ‘2-year rule’, that would allow the International Seabed Authority to begin taking applications for commercial deep sea mining projects by July 2023 with whatever rules are in place at that time.

This will focus a great deal of attention on TMC as the deadline approaches and creates great uncertainty over whether – and how – TMC’s subsidiary may be granted a licence.