Science-based advocacy

The Deep Sea Mining Campaign is dedicated to rigorous, evidence-based advocacy

Since 2011 the Deep Sea Mining Campaign (DSMC) has conducted rigorous science-based advocacy compiling high-quality research that provides transparent and evidence-based insights, essential for informed decision-making on deep sea mining (DSM)

Led by DSMC’s Dr. Helen Rosenbaum, we have published eight comprehensive reports and information briefs, each grounded in thorough research and reviewed by independent scientists.

Our research highlights the significant environmental, social, and economic risks posed by DSM and that the impacts will be extensive, severe and last for generations, causing essentially irreversible species loss and ecosystem degradation.

DSM should have no place in a future where the health of our oceans and the well being of the communities that depend on them are paramount.

OUR RESEARCH

NEWS & RESOURCES

Despite the industry’s push to exploit our oceans under the guise of supporting a carbon-free economy, research shows that deep sea mining is not necessary for a sustainable future. We advocate for better management of land-based resources, recycling, and reducing demand—alternatives that can meet global mineral needs without devastating our oceans.

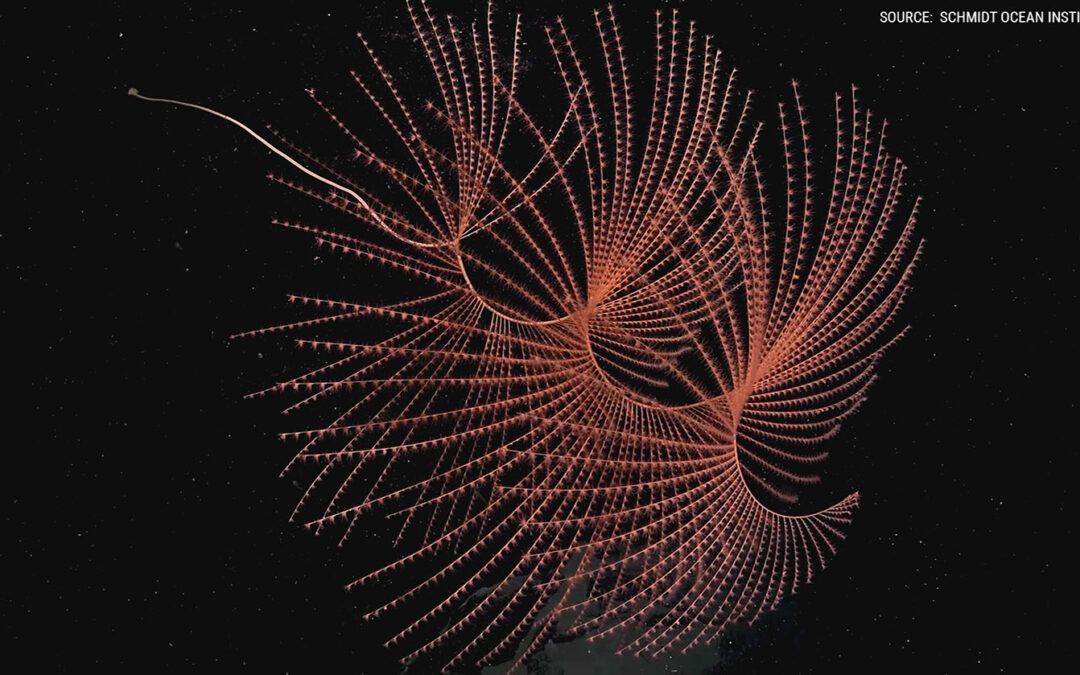

The impacts of DSM are severe and long-lasting, with potential damage to marine life, water quality, and even human health. The deep sea is far from an ecological desert; it’s a vibrant, biodiverse world that we barely understand.

This was made evident in our 2020 report, Predicting the impacts of mining of deep sea polymetallic nodules in the Pacific Ocean: A review of Scientific literature that details scientifically established risks, including those related to the lack of knowledge surrounding this emerging industry.

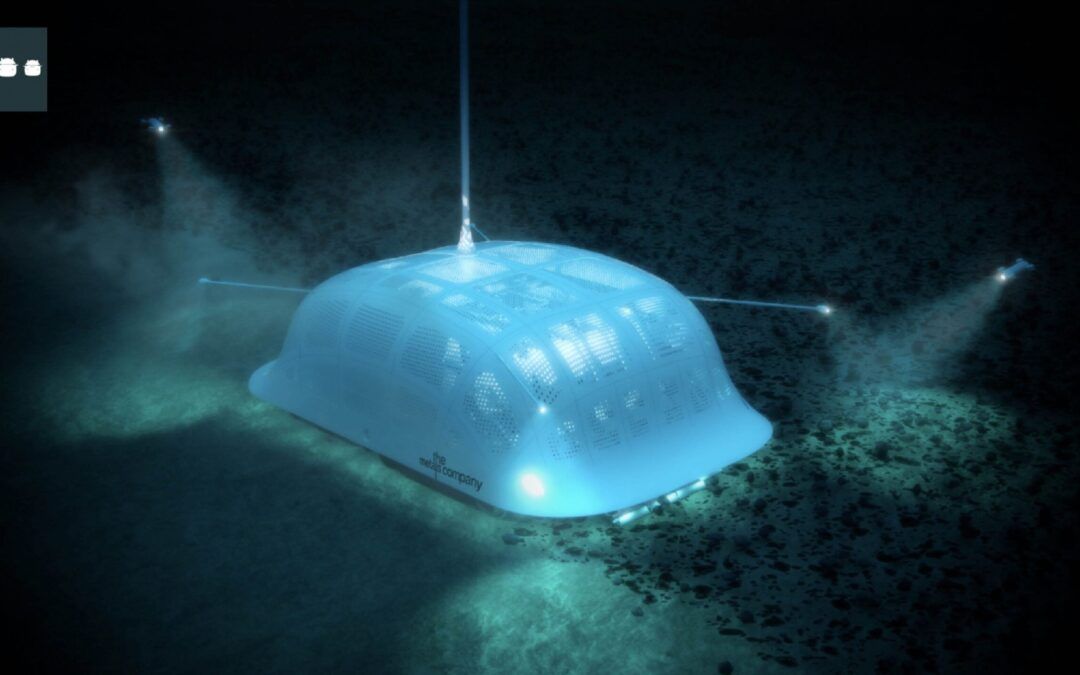

Briefing Paper: Impossible Metals = Impossible Promises

Our 2025 research paper, Impossible Metals = Impossible Promises, critically examines the claims made by U.S. start-up Impossible Metals. Our analysis of the company’s own modelling concludes that in contrast to their claims, the mining method proposed is neither sustainable nor selective. The company fails to demonstrate any scientific basis for their assertions.

This paper highlights significant risks to the viability of deep sea ecosystems and the functions they provide for the planet. The consequences would only become evident through long term studies, by which time the impacts of commercial mining would effectively be irreversible.

As the race for critical minerals intensifies, this paper underscores the urgent need for precaution and scientific integrity – not corporate greenwashing – when it comes to our deep ocean commons.

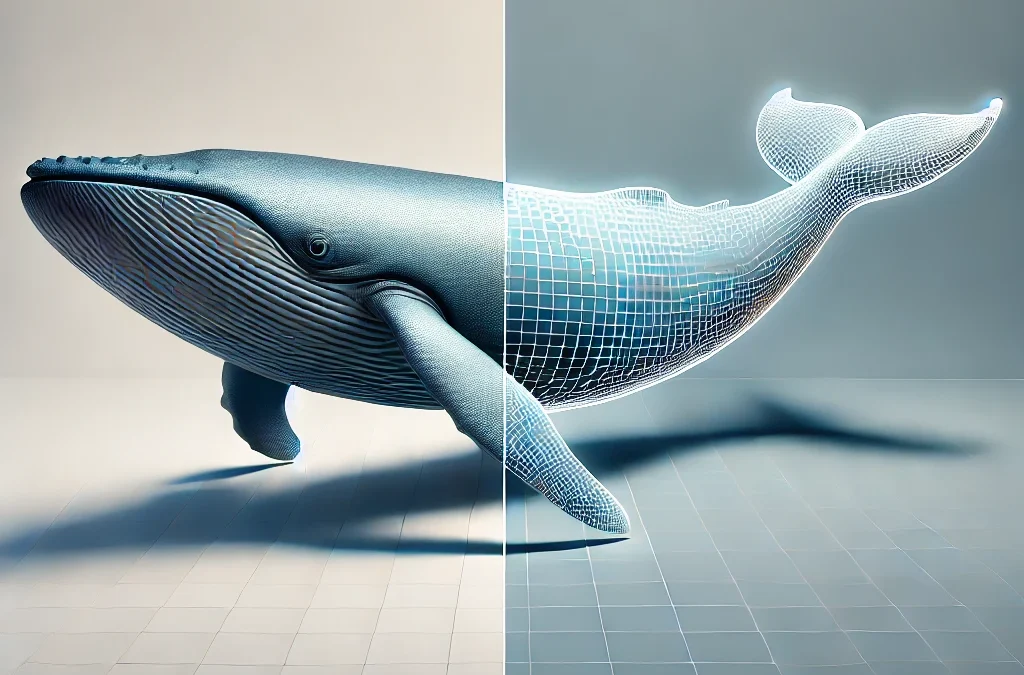

Digital Twin Technology and Adaptive Management Systems

In 2024 our report, Digital Twin Technology and Adaptive Management Systems for Deep Sea Mining: Limitations and the Risk of Self-Regulation, exposes the risks and limitations of using digital twin technology in the emerging deep sea mining industry. Promoted as a solution to mitigate risks and improve decision-making, digital twin technology fails to address critical uncertainties in deep-sea environments.

This briefing reveals how reliance on digital twins and adaptive management systems are a slippery slope toward self-regulations. It could undermine environmental safeguards and risk irreversible harm to ocean biodiversity.

Key insights include:

Technological Gaps: Significant limitations in replicating deep-sea ecosystems and processes.

Environmental Risks: Overlooked uncertainties that could exacerbate biodiversity loss.

Call for Caution: Why digital twins should not be a substitute for precautionary measures.

The report urges policymakers, scientists, and stakeholders to critically evaluate claims about digital twin technology and adaptive management systems and prioritise the precautionary principle in deep sea mining discussions.

Blue Peril: Mining Polymetallic Nodules in the Pacific Ocean

In 2020, we produced a significant report, Predicting the impacts of mining of deep sea polymetallic nodules in the Pacific Ocean: A review of Scientific literature.

More than 250 scientific and other articles were examined to explore what is known — and what remains unknown — about the risks of nodule mining to Pacific Ocean habitats, species, ecosystems and the people who rely on them. The report details scientifically established risks, including those related to the lack of knowledge surrounding this emerging industry.

Building on this report and Why the Rush for Deep Sea Mining, DSMC collaborated with INTERPRT and Ozeanien-Dialog to produce Blue Peril in 2022, a 16-minute visual investigation that presents a scientifically robust and disturbing picture of the far-reaching impacts of DSM for Pacific Island communities.

Perhaps the most alarming prediction that Blue Peril makes is that it would take only 3 months for the waste discharged by The Metals Company in its Tonga Licence area to reach Hawaiian waters and the Northern Line Islands of Kiribati and the United States.

Translated into eight languages Blue Peril worked with Austides Australia Consulting, Dr. John Luick to create the oceanographic modelling and analysis.

Why the Rush: Seabed Mining in the Pacific Ocean

In 2019, in collaboration with London Mining Network and MiningWatch Canada, the DSMC produced a hard-hitting report Why the Rush: Seabed Mining in the Pacific Ocean. Focusing on the companies driving the speculative rush for DSM the report exposed the unholy alliance with the very UN body charged with regulating them, the International Seabed Authority (ISA).

It revealed how a few first-mover companies had partnered with select Pacific island governments to obtain prospecting tenements for the ocean floor, leveraging tenements to raise hundreds of millions of dollars in speculative capital.

This rush, sparked the interest of bigger players, including UN agencies, state actors, the European Union, multinational mining companies, and even a global military and defence company.

An Overview of Chinese Policy, Activity and Strategic Interest Relating to Deep Sea Mining in the Pacific Region

China is one of the most important countries with respect to the emerging seabed mining industry. This report by Richard Page and commissioned by DSMC in 2018 covers several reasons for this assessment including:

- China’s heavy investment in the development of its seabed mining industry and associated technology;

- China is actively exercising its political power in the relevant international fora; and

- China plays a huge part in the current global market for minerals as both a producer and consumer.

Socio-political and Regulatory Context of Deep Sea Mining in Papua New Guinea

In 2016, DSMC the Socio-political and Regulatory Context of Deep Sea Mining in Papua New Guinea for Bread for the World Pacific Regional Office, led by Dr. Helen Rosenbaum with field support from Rosa Koain and Christina Tony, and logistical aid from the Bismarck Ramu Group in Papua New Guinea.

The research team interviewed 50 stakeholders and conducted five group interviews in Madang, Kavieng, Kokopo, and Port Moresby. They visited communities on the west coast of New Ireland Province, Duke of York Islands, and Karkar Island.

Stakeholders included government officials, church representatives, NGO leaders, community and women’s leaders, researchers, parliament members, a tourism operator, and fishery cooperative managers

Accountability Zero: A Critique of Nautilus Minerals Environmental and Social Benchmarking Analysis of the Solwara 1 project

In 2015, DSMC collaborated with Economists at Large, Earthworks, MiningWatch Canada and Oasis Earth to produce Accountability Zero: A Critique of Nautilus Minerals Environmental and Social Benchmarking Analysis of the Solwara 1 project.

The report critiqued the Nautilus Minerals Environmental and Social Benchmarking Analysis (ESBA) revealing its indefensible flaws.

It found that the ESBA uses metrics that bear no relevance to deep sea and marine environments and failed the accepted requirements of a cost-benefit analysis. Thus the ESBA failed to provide a framework to assist decisions about the advisability of the Solwara 1 DSM project in Papua New Guinea or of any other DSM project.

Physical Oceanographic Studies in Support of Environmental Impact Assessments for Proposed Mining

In 2012, DSMC followed up the Out of Our Depth: Deep Sea Mining in Papua New Guinea report with a more detailed review of the physical oceanographic elements of the Nautilus Solwara 1 EIS. We chose to look at these aspects due to their critical importance to the level of risk that coastal communities and marine ecosystems will be exposed to. This review finds that the oceanographic aspects of the EIS suffer from a lack of rigour. There are many errors and omissions in the modelling, presentation and analysis of data. As a result the EIS seriously downplays the risks facing local communities and the marine environment

Physical Oceanographic Assessment of the Nautilus Environmental Impact Statement for the Solwara 1 Project – An Independent Review was authored by Dr John Luick from Austides. Dr Luick has over twenty years of experience in projects related to ocean monitoring, tidal analysis, and hydrodynamic modelling. He has numerous publications and technical reports as well as wide experience in teaching, consulting, and shipboard observations.

Our of Our Depth: Deep Sea Mining in Papua New Guinea

The DSMC journey began in 2011 with a critical report, Out of Our Depth: Deep Sea Mining in Papua New Guinea, which was created in response to community concerns about the Solwara 1 mine in the Bismarck Sea in Papua New Guinea – the first DSM project in the world to be giving an operating licence.

The report was a first of its kind, exposing the potential dangers of DSM. It provided an overview of DSM in general with a focus on now the defunct DSM miner, Nautilus Minerals Solwara 1 project. It raised significant concerns about gaps in the Solwara 1 Environmental Impact Statement (EIS) and the many risks that remained to be identified and assessed.

This report was followed by a more detailed review Physical Oceanographic Assessment of the Nautilus Environmental Impact Statement for the Solwara 1 Project – An Independent Review.